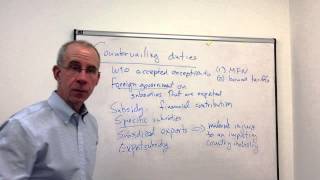

Countervailing Duties

Countervailing duties are tariffs or other duties that a government imposes on imported goods to offset subsidies provided to the exporters of those goods. When subsidized imports cause material injury to the domestic industry in the importing country, countervailing duties can provide relief to the injured industry.

The purpose of countervailing duties is to create a level playing field for domestic producers by ensuring that they compete on an equal footing with subsidized imports. Countervailing duties can also help protect jobs in the domestic industry by keeping prices and wages high enough to sustain those jobs.

In order to impose countervailing duties, the importing country must first establish that there is a subsidy from the exporting country and that the subsidized imports are causing material injury to the domestic industry. The World Trade Organization (WTO) is responsible for adjudicating disputes over whether subsidies exist and whether they are causing injury.

If the WTO finds that there is a subsidy and that the subsidized imports are causing injury, then the importing country can impose countervailing duties. These duties must be equivalent to the amount of the subsidy and must be applied to all subsidized imports from the exporting country.

The application of countervailing duties can be controversial, as it can lead to trade disputes between countries. However, if done correctly, countervailing duties can provide a necessary level playing field for domestic producers and help protect jobs in the domestic industry.

Related Links

What are Anti-Dumping and Countervailing Duties?

Countervailing Duties (CVDs)

Definition of Countervailing Duties – What is Countervailing Duties ? Countervailing Duties Meaning – The Economic Times

What is Countervailing duties? Definition and meaning

What are Anti-Dumping (AD) and Countervailing Duties (CVD)?

Anti-dumping (AD) and Countervailing duties (CVD)

7 Antidumping and Countervailing Facts Importers Should Know

Related Videos

countervailing duties

Learn the Basics of Antidumping and Countervailing Duties [Full Webinar]

Anti-Dumping and Countervailing Duties

-

countervailing duties

-

Learn the Basics of Antidumping and Countervailing Duties [Full Webinar]

-

Anti-Dumping and Countervailing Duties